menu

close

NewsContact Us

search

close

- Americas

- Asia Pacific

- Europe

- Middle East and Africa

AlbaniaAndorraArmeniaAustriaAzerbaijanBelgiumBulgariaCroatiaCyprusCzech RepublicDenmarkEstoniaFinlandFranceGeorgiaGermanyGreeceHungaryIrelandItalyKazakhstanLatviaLiechtensteinLithuaniaLuxembourgMaltaMoldovaNetherlandsNorwayPolandPortugalRomaniaSerbiaSlovakiaSloveniaSpainSwedenSwitzerlandTajikistanTurkeyUkraineUnited KingdomUzbekistan

Seven ways to create harmony in a family business

Family businesses are to be celebrated. Through tough times they can be especially resilient and in good times there is a sense of pride and togetherness. If run properly, they generally attract greater customer, staff and public loyalty.

Where they go wrong is when the lines between family matters and business affairs become blurred. A sense of entitlement may grow which leads to resentment. Some family members may be seen as working harder than others and some putting more financial demands on the business than others. Key employees can often see family interests taking precedence over the best business decisions. Time and again we have witnessed considerable distress between siblings or between generations arising from these issues.

It is a relatively new phenomenon in Ireland to have successful businesses pass from generation to generation with true value and wealth. Many other countries, for example Germany, have been adept at transferring businesses through the generations and have well-established structures to handle these transitions.

The key to success is to separate family affairs from business affairs. Over a couple of generations, it is foreseeable that an initial two-person business could have over twenty shareholders. Can they all expect a job and a meaningful living? Do they have the skills? Can a business have twenty bosses? Clearly this can be a route to disaster and a destroyer of value.

Properly structured a family business can be a source of true pride, value creation and wealth for everyone. However, there must be rules to govern these circumstances. As Caroline Keeling, CEO of Keelings, says “A family business should be run like any other whilst also being mindful of family relationships”.

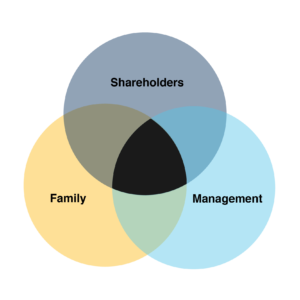

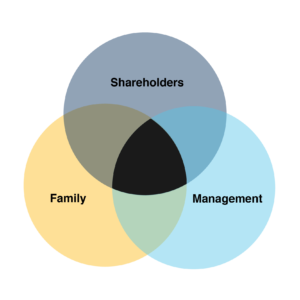

There are three separate relationships which must understood and respected, with responsibilities and benefits clearly assigned and separated. The interests of these groups overlap but over time and through generations, needs and connections will diverge. Thus ground rules are needed to cover all the operational matters one would expect.

So what are the seven common areas to address in a family business?

1. Deal with how the three elements of the family will work in harmony

Family – Shareholder – Manager.

What level of input does each group have? How often do they meet? Do they elect representatives from their group to speak on the groups behalf?

2. Set a core purpose or objective for the business.

Many successful family businesses focus on a core purpose of the enterprise. This allows clarity in decisions as well as engagement of the wider shareholder, non-management family. But often family businesses can have a founding commitment to a community or a cause as well as a core activity which family members want to honour, which needs to be considered.

3. Engage outside talent

Non-executive board members and professional non-family management can prove a great asset to a business. They bring balance, an outside perspective and because they don’t have same ties to the family can often act as honest broker in bringing resolution to family and business matters. Caroline Keeling says about their external board members, “The non-family board members, I personally think, are really important,” she advises. “It’s easier sometimes for a non-family board member to raise an issue than for a family member to.”

4. Set clear objectives for the executive in the performance of the business.

It is the job of the executives running the business to work on behalf of the shareholders in fulfilling their wishes. In normal commercial enterprises this may be easily defined but in family business there may be other objectives such as a “founders purpose” mentioned above to be taken into consideration.

5. Divestment of shares

How are shares to be valued and how they are offered to other family members? Most family agreements do not allow disposal to an outside source. However, this means that a fair price should be set to allow smooth transfer.

6. Reporting to shareholders and payment of dividends

As families increase through generations, many shareholders will pursue non-business activities and thus become less involved or connected to day-to-day activity. However, they are still more than shareholders within the complex relationships of families and thus their needs and interests need to be recognised. Regular reporting and meetings may be needed.

7. Keep family life and business life separate

Many families insist that no business can be discussed at family gatherings. This allows for a more balanced approach where business does not dominate the family life or where any issues related to the boardroom do not ruin family tine together.

In summary, accumulating, preserving and managing wealth within a family business can work in harmony with running a family. It can be a source of real value creation and purpose, but equally can give rise to value destruction and family disharmony if not actively managed.

Crowe partner Gerard O’Reilly manages our Business Value Builder Programme, a practical and effective programme for company owners to build lasting value in their business. Contact Gerry if you would like to find out how he can help you achieve your personal and business goals.

Where they go wrong is when the lines between family matters and business affairs become blurred. A sense of entitlement may grow which leads to resentment. Some family members may be seen as working harder than others and some putting more financial demands on the business than others. Key employees can often see family interests taking precedence over the best business decisions. Time and again we have witnessed considerable distress between siblings or between generations arising from these issues.

It is a relatively new phenomenon in Ireland to have successful businesses pass from generation to generation with true value and wealth. Many other countries, for example Germany, have been adept at transferring businesses through the generations and have well-established structures to handle these transitions.

The key to success is to separate family affairs from business affairs. Over a couple of generations, it is foreseeable that an initial two-person business could have over twenty shareholders. Can they all expect a job and a meaningful living? Do they have the skills? Can a business have twenty bosses? Clearly this can be a route to disaster and a destroyer of value.

Properly structured a family business can be a source of true pride, value creation and wealth for everyone. However, there must be rules to govern these circumstances. As Caroline Keeling, CEO of Keelings, says “A family business should be run like any other whilst also being mindful of family relationships”.

There are three separate relationships which must understood and respected, with responsibilities and benefits clearly assigned and separated. The interests of these groups overlap but over time and through generations, needs and connections will diverge. Thus ground rules are needed to cover all the operational matters one would expect.

So what are the seven common areas to address in a family business?

1. Deal with how the three elements of the family will work in harmony

Family – Shareholder – Manager.

What level of input does each group have? How often do they meet? Do they elect representatives from their group to speak on the groups behalf?

2. Set a core purpose or objective for the business.

Many successful family businesses focus on a core purpose of the enterprise. This allows clarity in decisions as well as engagement of the wider shareholder, non-management family. But often family businesses can have a founding commitment to a community or a cause as well as a core activity which family members want to honour, which needs to be considered.

3. Engage outside talent

Non-executive board members and professional non-family management can prove a great asset to a business. They bring balance, an outside perspective and because they don’t have same ties to the family can often act as honest broker in bringing resolution to family and business matters. Caroline Keeling says about their external board members, “The non-family board members, I personally think, are really important,” she advises. “It’s easier sometimes for a non-family board member to raise an issue than for a family member to.”

4. Set clear objectives for the executive in the performance of the business.

It is the job of the executives running the business to work on behalf of the shareholders in fulfilling their wishes. In normal commercial enterprises this may be easily defined but in family business there may be other objectives such as a “founders purpose” mentioned above to be taken into consideration.

5. Divestment of shares

How are shares to be valued and how they are offered to other family members? Most family agreements do not allow disposal to an outside source. However, this means that a fair price should be set to allow smooth transfer.

6. Reporting to shareholders and payment of dividends

As families increase through generations, many shareholders will pursue non-business activities and thus become less involved or connected to day-to-day activity. However, they are still more than shareholders within the complex relationships of families and thus their needs and interests need to be recognised. Regular reporting and meetings may be needed.

7. Keep family life and business life separate

Many families insist that no business can be discussed at family gatherings. This allows for a more balanced approach where business does not dominate the family life or where any issues related to the boardroom do not ruin family tine together.

In summary, accumulating, preserving and managing wealth within a family business can work in harmony with running a family. It can be a source of real value creation and purpose, but equally can give rise to value destruction and family disharmony if not actively managed.

Crowe partner Gerard O’Reilly manages our Business Value Builder Programme, a practical and effective programme for company owners to build lasting value in their business. Contact Gerry if you would like to find out how he can help you achieve your personal and business goals.